Home Insurance Premiums

Places in the UK you’re likely to pay more to insure your home

When buying a home, one should consider all of the potential costs involved. Especially since there is so much that can go wrong in owning a house, accidental damage, faulty fixtures, and even natural disasters; enter home insurance.

Whether you outright buy your home or have a mortgage, it’s perfectly sensible to buy cover for your investment. In combination with a burglar alarm, home insurence can provide the ultimate reassuring safety net.

However, a major factor when buying home insurance is your location and the risks associated with it. So, we have looked at flood risk and crime rates at various locations in the UK, to show you where you might pay more for home insurance.

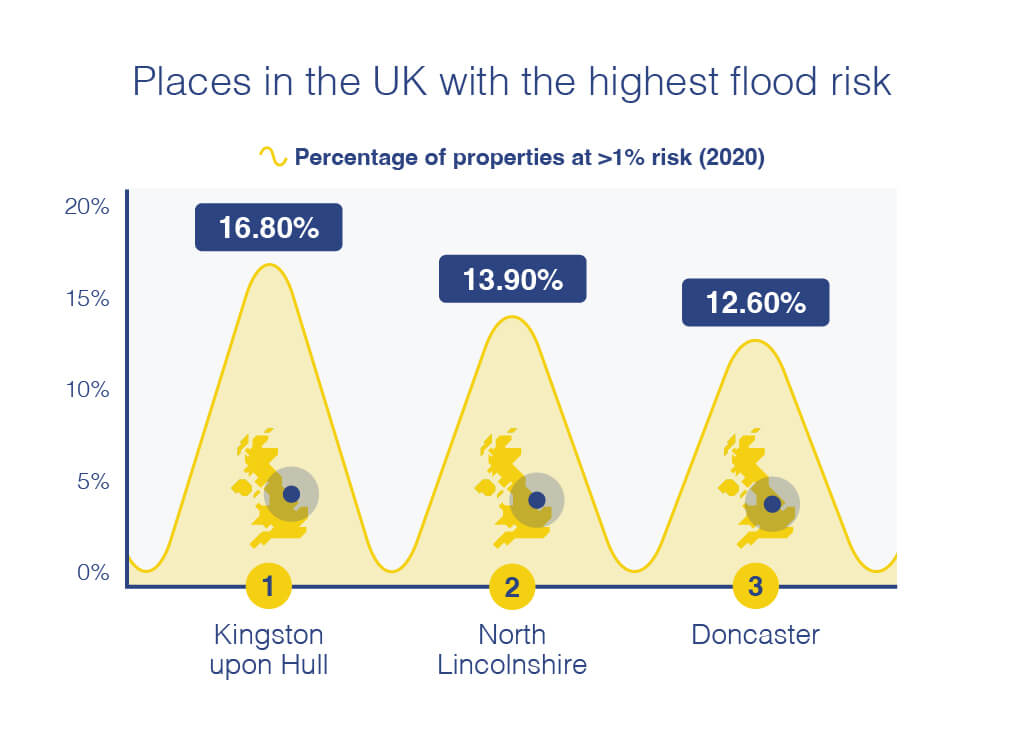

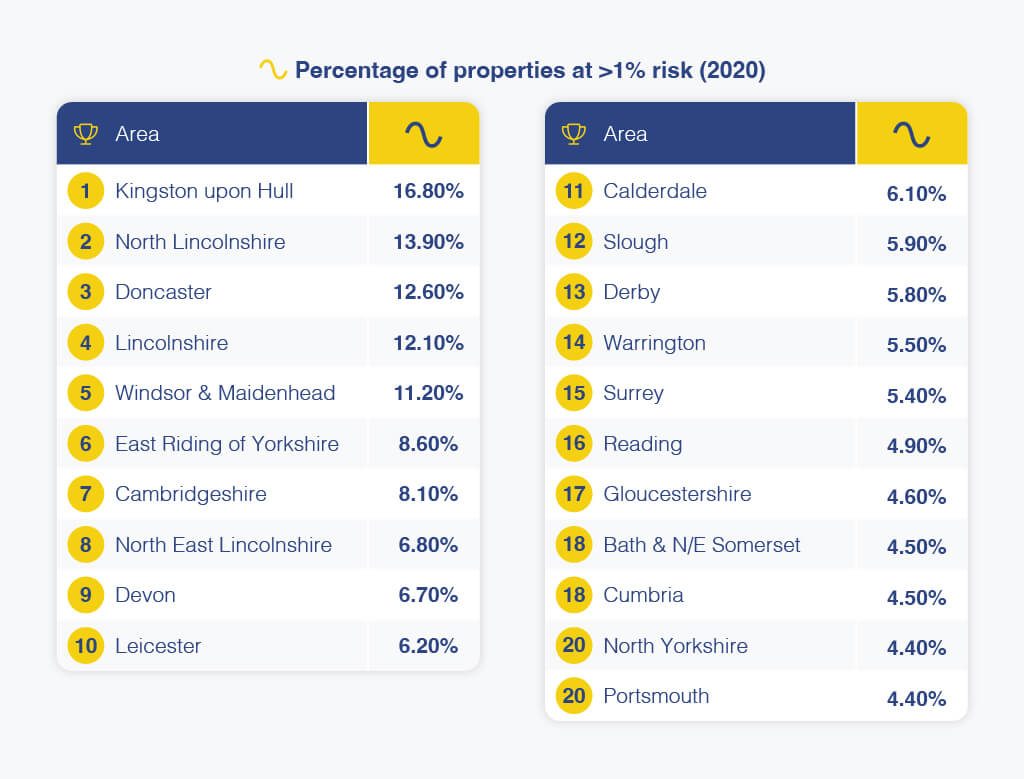

Places in the UK with the highest flood risk

1) Kingston upon Hull

Percentage of properties at >1% risk: 16.80%

Coming in with the highest flood risk in the UK, is Kingston Upon Hull, the 2017 City of Culture. The East Yorkshire city was hit heavily with flooding back in 2007, caused by intensely heavy rainfall. Current figures show that Hull has 16.8% of its properties showing a higher than 1% risk for flooding, indicating a potentially higher home insurance cost.

2) North Lincolnshire

Percentage of properties at >1% risk: 13.90%

North Lincolnshire comes in second, with 13.9% of its properties being at a higher than 1% risk of flooding. The area is located just south of Hull and as recently as February 2022, the area was issued with flood warnings, due to heavy rainfall causing the River Ancholme to rise.

3) Doncaster

Percentage of properties at >1% risk: 12.60%

Doncaster has the third highest flood risk in the UK, with 12.6% of its properties being at a greater than 1% risk of flooding. In 2019, the River Don rose to record levels due to heavy rainfall. There were concerns that the banks of the river may collapse and as such many people were evacuated.

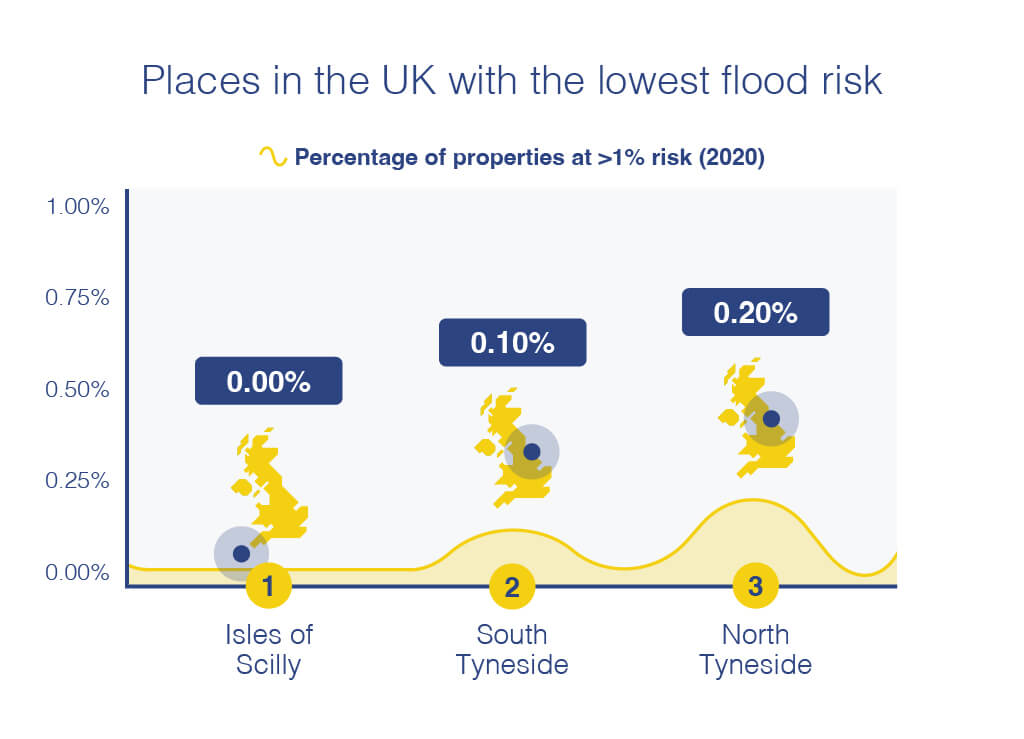

Places in the UK with the lowest flood risk

1) Isles of Scilly

Percentage of properties at >1% risk: 0.00%

The Isles of Scilly have the lowest flood rate in the UK and as a consequence, potentially a lower cost for home insurance. Current data shows that 0% of the isles’ properties are at a greater than 1% risk for flooding.

2) South Tyneside

Percentage of properties at >1% risk: 0.10%

South Tyneside comes in as the area with the second-lowest flood rate in the UK. Just 0.1% of the area's properties are at a greater than 1% flood risk. This would again be indicative of a lower cost for home insurance.

3) North Tyneside

Percentage of properties at >1% risk: 0.20%

And with the third-lowest flood risk in the UK, we have the other half of Tyneside. The area has recorded that a mere 0.2% of its properties are at a greater than 1% risk for flooding. It would appear that Tyneside is the place to be for low flood risks.

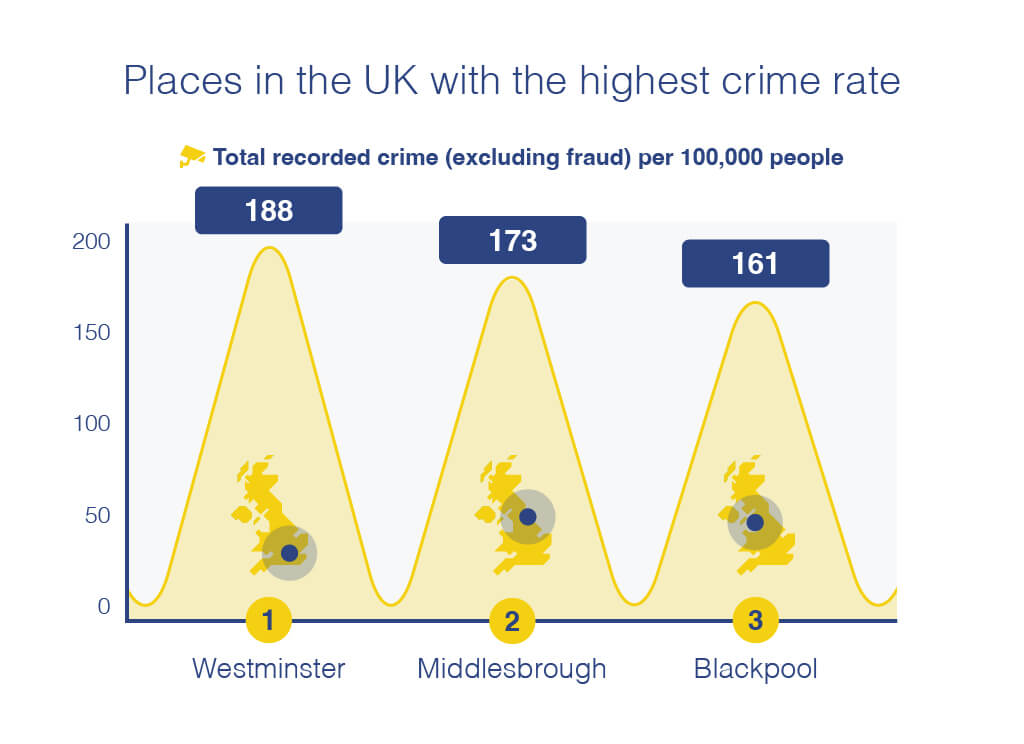

Places in the UK with the highest crime rate

1) Westminster

Total recorded crime (excluding fraud) per 100,000: 188

Westminster, the bustling London borough, where the Houses of Parliament are located, has the highest crime rate in the UK. When calculated per 100,000 of the population, the total recorded crimes for the area stand at 188. With the high housing cost in London to begin with, this potential increase for home insurance certainly isn’t favourable.

2) Middlesbrough

Total recorded crime (excluding fraud) per 100,000: 173

Middlesbrough comes in with the second-highest crime rate in the UK. Located in North Yorkshire, Middlesbrough recorded 173 total crimes per 100,000 of the population, indicating a higher cost for home insurance due to this high risk.

3) Blackpool

Total recorded crime (excluding fraud) per 100,000: 161

And with the third-highest crime rate in the UK, we have Blackpool, the seaside town located in Lancashire. The town has recorded a total of 161 crimes when calculated per 100,000 of the population.

Places in the UK with the lowest crime rate

1) Isles of Scilly

Total recorded crime (excluding fraud) per 100,000: 23

Once again, just off the Cornish coast, we have the Isles of Scilly. Again, the Southwestern isles have the lowest risk, with 23 total crimes reported per 100,000 of the population. With such low crime figures, you should surely expect to be paying less on your home insurance.

2) Wealden

Total recorded crime (excluding fraud) per 100,000: 36

Wealden, located in the East of Sussex, has the second-lowest crime rate in the UK. Having recorded just 36 total crimes for the year ending December 2021 per 100,000 of the population, you should expect cheaper rates on your home insurance.

3) North Kesteven

Total recorded crime (excluding fraud) per 100,000: 36

North Kesteven is located in Lincolnshire and its council is based in Sleaford. The area boasts the third-lowest crime rate in the UK. The area recorded just 36 total crimes per 100,000, during the year ending December 2021.

Home insurance experts at Uswitch comment:

“Home insurance offers valuable financial protection against many things that can go wrong in your home, such as fire or theft. Although it can be expensive, having no cover will cost you much more in the event that the unexpected happens to your property."

Without valid insurance cover, you won’t be able to claim back the cost of repairing your home or replacing its contents. You can also look for the best home insurance deals to ensure you’re not paying more than you need to.

Here are four tips on how to reduce the cost of your home insurance

1) Shop around for the best deal and pay annually for your insurance

Home insurance prices can vary significantly between each provider, so make sure you shop around for the best deal and the best value insurance for your needs. Additionally, most insurers will allow you to pay for your policy either in monthly instalments or in one large payment. If you can afford to, paying all of your premiums at the same time will save you money in the long term because some insurers tend to add interest payments on monthly instalments. However, not all insurers do add interest to monthly payments so it’s worth shopping around to find the best policy for you.

2) Avoid cover you do not need and consider buying a combined policy

Insurers will always offer you a range of extras when you apply for home insurance. These include things like accidental damage cover, home emergency cover and legal expenses cover. Insurers will usually charge you extra for these, and in many cases they aren’t needed. Only pay for what you need. Similarly, home insurance can often come as two separate policies: buildings insurance and contents insurance. Many insurers will offer discounted prices if you buy both policies with them.

3) Secure your home

Having a secure home means you are less at risk of being burgled, this means you are less likely to make a claim on your insurance, which will help you build up a no-claims bonus. Every year you don’t make a claim, you earn a no-claims bonus. There are several ways you can avoid potential burglaries, including updating your locks, hiding valuables from sight, and setting your alarm whenever you leave the house. Home insurance providers will ask you specific questions about what sort of locks you have (on windows as well as doors). Make sure you answer as accurately as possible and you could get lower premiums as a result. Alternatively if you don’t have the most secure locks, then upgrading your security could mean a cheaper policy.

4) Select an NSI accredited home security provider

When looking for a home security provider, be sure to check if they are certified by the National Security Inspectorate. There are two certifications awarded by the NSI, silver and gold, both of which are decided by a vast number of factors, including company finances, general and maintenance contracts and twenty-four hour security cover. When security companies are NSI certified, you can be sure that they are highly professional, technically competent and that they are reputable and trustworthy. Furthermore, depending on the rating given by the NSI, you may end up being offered a reduced premium on your insurance.

5) Keep track of your keys

This seems like an obvious one, but keeping track of your house key is very important. If a burglar enters your home using a key (which you have lost or left under your matt), you will very likely not be able to make a claim. Insurers will not pay out on a claim where there are no signs of forced entry. Try not to leave keys around your home in “hidden” places as burglars know all the most common hiding spots. If you lose your keys or they’re stolen, having a locksmith replace the locks on your home should be your priority.

If you do need to make a home insurance claim then make sure you check your policy. Your home insurance policy booklet will have all the details on what your insurance covers, including any exceptions. When you contact your home insurance company, make sure you have your home insurance policy number, the date the claim arose, and know why you need to claim. Make sure you take photos and document evidence and don’t start any repairs or replace any items before you have the go-ahead from your insurer. You must make sure you are covered first. If you need to make emergency repairs immediately, be sure to take photos and keep all receipts.

Methodology

We started with the flood data, using the National Audit Office’s most up-to-date data for flood risk in the UK, looking at the individual areas within local authority data. The most recent data is from 2020.

And for the crime rates data, we looked at the Office for National Statistics. We took the dataset from the year ending December 2021, which shows total reported crimes per 100,000 of each area's population.